Germany: Reaching net zero while safeguarding social cohesion

By Robert Grundke, Zeev Krill, and Marius Bickmann, OECD Economics Department

Germany is still a large emitter of greenhouse gases, but it is also at the forefront of efforts to reduce them. It has set an ambitious target of reaching climate neutrality in 2045, which requires tripling the speed of emission reductions relative to the period between 1990 and 2019. Soaring energy prices and the need to replace Russian energy imports have only amplified the determination to act.

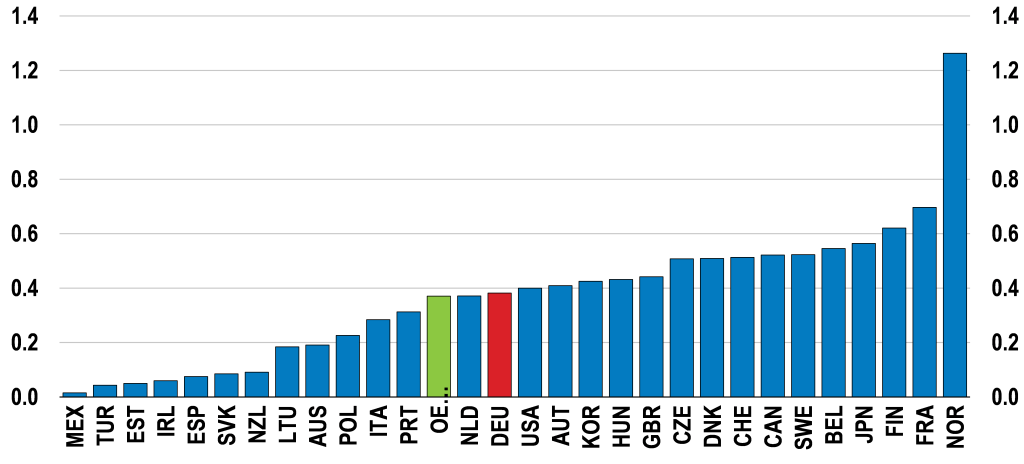

Figure 1. Germany is still a large emitter of greenhouse gases

Note: Panel A shows countries with the highest share of global emissions.

Source: IEA Greenhouse gas emissions from energy database.

According to empirical analysis for the 2023 Economic Survey of Germany, accelerating emission reductions is likely to hurt energy-intensive industries exposed to international trade. It would also lead to a significant reallocation of labour across sectors and firms, raising adjustment costs for workers and increasing inequalities and regional disparities.

Figure 2. Reaching ambitious climate targets would lead to heterogenous effects across sectors and regions

Source: (Bickmann et al., forthcoming).

How can Germany reach net zero cost-effectively while maintaining social cohesion? The 2023 Economic Survey of Germany identifies six priorities:

1. Keep relying on carbon pricing mechanisms, to effectively reduce emissions while minimising the economic costs of the green transition. In 2021, Germany already priced 90% of its GHG emissions, explicitly or implicitly, with an average effective marginal carbon rate of EUR 81, up by 46% since 2018. But meeting its ambitious objective of reducing emissions by 65% by 2030 (compared to 1990 levels) will require even higher prices. The shift to a cap-and-trade system for non-ETS sectors (mainly buildings and transport) should be phased in earlier, and its cap should be aligned with a unified emission reduction target for all sectors regulated under the National Trading System (at least until the European trading system for road transport and heating starts operating). Setting a floor for prices in this system will make future carbon prices more predictable and reduce risks for investing in low-carbon projects.

2. Phase out environmentally harmful fossil fuel subsidies and tax expenditures, such as the energy tax relief for diesel fuel, the commuter allowance or the favourable tax treatment for privately owned company cars. These environmental subsidies and tax expenditures amount to up to EUR 65 billion, weaken and distort price signals, hamper the market breakthrough of environmentally friendly products, and jeopardise climate goals. Additional revenue from phasing out these subsidies and tax expenditures could be used for abatement subsidies or direct transfers to support vulnerable households.

3. Gradually shift support from price competitive renewable energies, towards subsidies for green R&D and the deployment of near-zero emission industrial technologies. Renewable energy subsidies help to reduce electricity prices and, therefore, support energy-intensive industries. However, analysis for the 2023 Economic Survey of Germany shows that they are costly and lead to higher emissions in other EU countries. Falling demand for emission certificates in Germany will lead to lower carbon prices in the EU Emission Trading System (ETS), as its overall emissions cap is fixed, and allow other countries to increase their emissions (the so-called waterbed effect). Risks to energy-intensive industries would be better managed by streamlining the planning and approval procedures for renewable energy and grid infrastructure projects, raising spending on R&D in the energy and industrial sectors – crucial for reducing future abatement costs – and continuing to push for international agreements that enforce faster global emission reduction. Moreover, as electricity supply from renewables has a higher variability compared to nuclear or coal power plants, accelerating the integration of the European electricity markets is key to better match demand and supply and raise energy security.

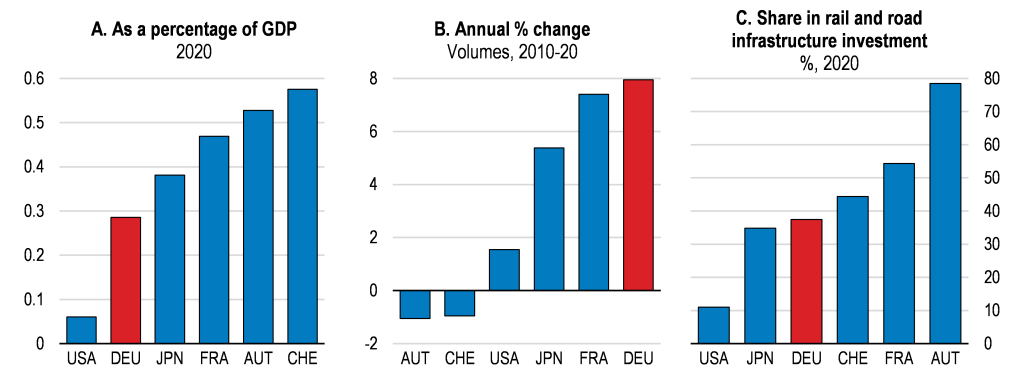

Figure 3. There is scope to increase public spending on green R&D

Public energy research, development, and demonstration (RD&D) budgets, Per thousand unit of GDP, 2021

4. Phase out untargeted subsidies and subsidies for mature technologies and use the available resources to better support vulnerable households and improve public infrastructure. For example, in the housing sector, untargeted subsidies should be phased-out and replaced by minimum efficiency standards and energy performance certification for existing buildings while providing loan support only for credit-constrained households. In the transport sector, the focus should shift from subsidising electric cars towards expanding the deployment of public charging points and public investment in rail. In the rail sector, it is key to accelerate the electrification of tracks, the digitalisation of the control and signalling systems and ensure that barriers to competition are reduced.

Figure 4. Investment in rail should increase further

Source: The International Transport Forum (ITF) database.

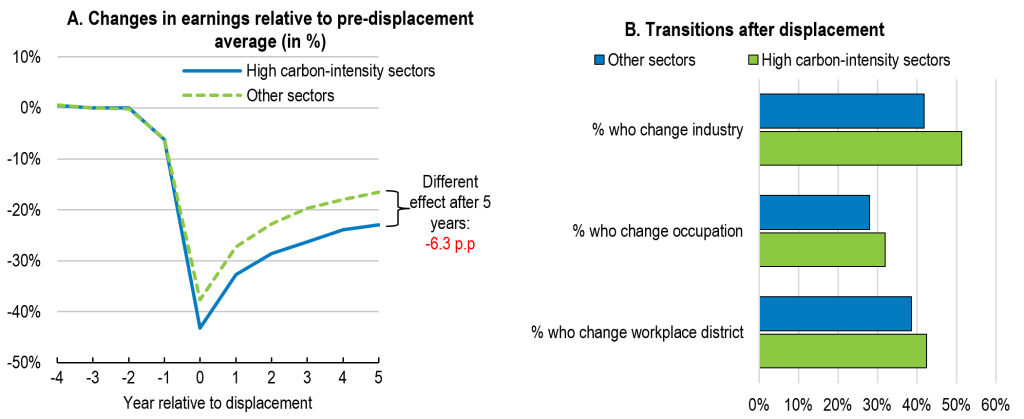

5. Expand the scope of Active Labour Market Programmes – focusing on vocational education and training, and mobility subsidies – to reduce adjustment costs for employees affected by the green transition. An analysis conducted for the 2023 Economic Survey of Germany found that displaced workers from high-carbon-intensity sectors tended to suffer lasting and more significant decreases in earnings than workers displaced from other sectors. Workers in high-carbon intensity sectors are older and have higher tenure, are more likely to have vocational education rather than more general tertiary education, and work in very specific occupations, which have a higher routine task content. The negative effects of these characteristics on earnings after displacement suggest that human capital specificity, particularly related to routine tasks, and lower basic skills, especially of older workers, play a major role in explaining the higher displacement costs for workers in high carbon-intensity sectors. However, displaced workers who were more mobile and moved to a different job outside their local labour market experienced better outcomes.

Figure 5. Displaced high carbon-intensity sector workers suffer lasting reductions in earnings

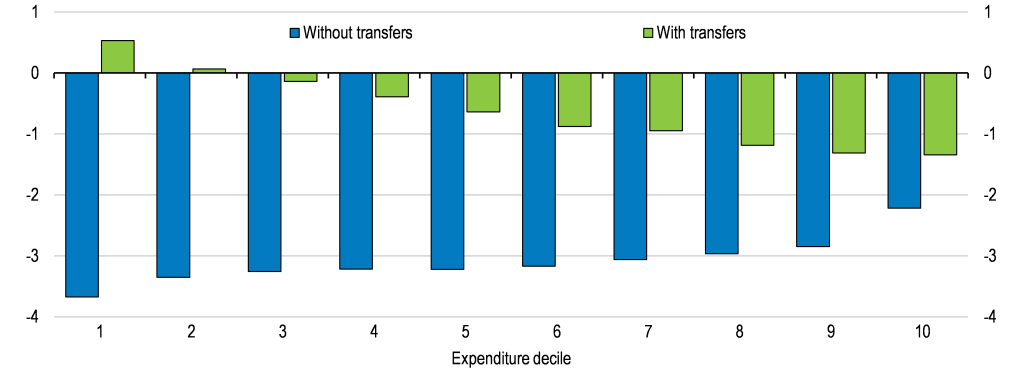

6. Use a higher share of carbon pricing revenues to support households during the green transition. If revenues are not recycled to households, poorer households could lose a considerable share of their real income due to a decline in wages as production costs rise, and due to increases in electricity, transport, and heating prices. In the poorest household decile, expenditures on energy and transport amount to 18.9% of total expenditures, which is considerably more than the share of these items in the total expenditures of the highest decile (10.1%). However, analysis conducted for the 2023 Economic Survey of Germany shows that if additional carbon pricing revenues are recycled as a lump sum, low-income households would benefit from more ambitious climate policies.

Figure 6. Recycling carbon pricing revenues as a lump-sum transfer to households would benefit poorer households

Real household income changes by expenditure decile, compared to the benchmark scenario (in %)

Source: (Bickmann et al., forthcoming[1]).

Reference:

OECD (2023), OECD Economic Surveys: Germany 2023, OECD Publishing, Paris, https://doi.org/10.1787/19990251.