Addressing high public debt: selective expenditure restraint matters

By Álvaro Pina, Mauricio Hitschfeld and Martin Borowiecki, OECD Economics Department

In dealing with significant fiscal challenges posed by ageing and the climate transition and the risk of rising future debt burdens, countries can draw on the lessons from past episodes of large and sustained reductions in debt-to-GDP. Work in the November 2023 OECD Economic Outlook found that there have been 34 sustained debt reduction episodes in OECD countries since the late 1970s, with 25 countries having experienced at least one such episode during this time. Reductions in the debt-to-GDP ratio have mainly hinged on achieving and sustaining a primary surplus over several years, largely via expenditure restraint, as well as favourable cyclical conditions and low interest rates. Expenditure restraint has often been accompanied by growth-friendly shifts in the composition of public spending.

What has made debt-to-GDP ratios fall?

Debt reduction episodes are defined as ones that persist for a minimum of five years and bring down the gross debt-to-GDP ratio by at least 10 percentage points. All episodes start in the year after the debt ratio peaks and end when the debt-to-GDP ratio bottoms out. The analysis spans from the late 1970s to 2019, though data availability is limited for some countries.

Accounting decompositions of changes in the debt-to-GDP ratio typically consider three components (Rawdanowicz et al., 2021): the primary balance-to-GDP ratio (hereafter the “primary balance”), the interaction of debt and the differential between interest rates and GDP growth (the so‑called “snowball effect”), and a residual stock-flow adjustment that summarises changes in gross debt unaccounted for by the budget balance. In turn, the average primary balance over each debt reduction episode can be decomposed into the initial balance when the debt ratio peaks and the average primary balance change over the length of the episode relative to the initial balance. Likewise, the aggregate snowball effect can be split to show separate impacts from real interest rates (with inflation measured by the GDP deflator) and real GDP growth.

The final decomposition of each debt reduction episode is shown in Figure 1. This highlights two key factors:

- In all but three episodes the primary balance is on average in surplus, helping to reduce the debt ratio. In around 80% of the episodes, this is due to improvements in the primary balance during the episode itself.

- In about two thirds of the episodes, and in all but one of the 14 episodes that have begun since the year 2000, the snowball effect contributes positively to the debt reduction. Cyclical conditions have almost always improved relative to those when the debt ratio peaked, and the real interest rate has often been only marginally positive or even negative.

Figure 1. Decomposition of the average annual change in the debt-to-GDP ratio during debt reduction episodes

Note: Episodes are ordered chronologically by starting year. See Annex 1.B. in OECD (2023) for further details.

Source: OECD Economic Outlook 113 database; and OECD calculations.

Expenditure restraint and shifts in the composition of public spending

Improvements in the primary balance during debt reduction episodes have mainly occurred due to declines in the primary expenditure-to-GDP ratio. This has taken place in over 80% of the 34 episodes considered. In contrast, the primary revenue-to-GDP ratio has risen in fewer than half of the episodes, mostly for ones that began in the 1980s and 1990s.

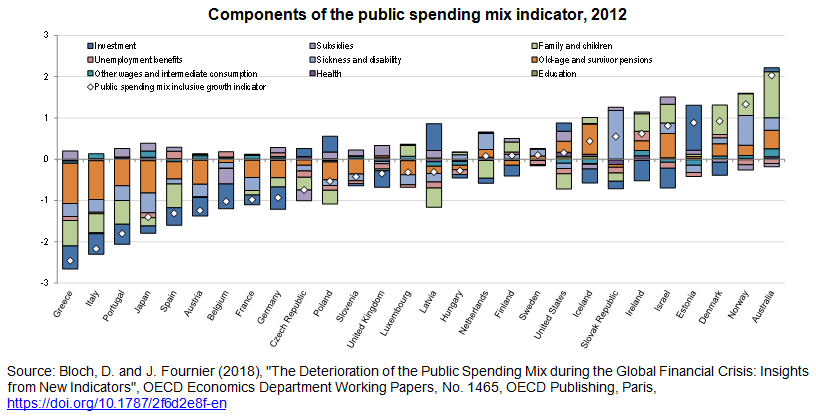

Expenditure restraint has often been accompanied, and likely made more sustainable, by relatively growth-friendly shifts in expenditure composition. Public investment as a share of GDP declined in about two-thirds of the episodes (23 out of 34; Figure 2), but these declines were often smaller than declines in other expenditure items, in contrast to the large public investment cuts often seen in consolidation episodes (Pina, 2016). Spending on education, health and family and children, generally regarded as growth- and equity‑friendly (Cournède et al., 2014; Fournier and Johansson, 2016), has generally been better preserved than spending on pensions and the bulk of non-education, non-health wages and intermediate consumption. Declines in the GDP share of the remainder of public expenditure, including subsidies, unemployment, sickness and disability benefits, other current transfers, and capital transfers have typically been the largest factor behind spending restraint. Many of these items are not growth-enhancing, though some can be very important for poorer households.

A positive differential between GDP growth and interest rates cannot be relied upon to decrease the debt-to-GDP ratio in the coming years, and attaining primary surpluses via expenditure restraint may prove difficult (Arslanalp and Eichengreen, 2023). This reflects the multiple future spending pressures governments face. Reductions in the debt ratio may thus be harder to achieve in the coming decade than in the past. However, past debt reduction episodes illustrate that it is possible to make significant savings in spending items which often harm growth, such as subsidies and certain transfers. In the current context, where the composition of public expenditure needs to change to address new challenges, that lesson remains highly relevant. However, such changes need to be accompanied by improvements to the overall targeting and design of spending programmes to maintain support for those who need it most.

Figure 2. Growth-friendly expenditure has typically been spared during debt reduction episodes

Changes in ratios to GDP, percentage points, average over each debt reduction episode

Note: The chart decomposes the average annual change in primary expenditure as a share of GDP over the length of each episode relative to its initial value into several expenditure components as defined in the OECD Public Finance Dataset (Bloch et al., 2016). In some earlier episodes not all components can be identified due to data limitations. Episodes are ordered chronologically by starting year. See Annex 1.B. in OECD (2023) for further details.

Source: OECD Economic Outlook 113 database; OECD Public Finance Dataset; and OECD calculations.

References

Arslanalp, S. and B. Eichengreen (2023), “Living with High Public Debt”, paper presented to Jackson Hole Conference, August 2023.

Bloch, D., Fournier, J.-M, D. Gonçalves and Á. Pina (2016), “Trends in Public Finance: Insights from a New Detailed Dataset”, OECD Economics Department Working Papers, No. 1345, OECD Publishing, Paris, https://doi.org/10.1787/4d3d8b25-en.

Cournède, B., A. Goujard and Á. Pina (2014), “Reconciling Fiscal Consolidation with Growth and Equity”, OECD Journal: Economic Studies, vol. 2013/1, https://doi.org/10.1787/eco_studies-2013-5jzb44vzbkhd.

Fournier, J. and Å. Johansson (2016), “The Effect of the Size and the Mix of Public Spending on Growth and Inequality”, OECD Economics Department Working Papers, No. 1344, OECD Publishing, Paris, https://doi.org/10.1787/f99f6b36-en.

OECD (2023), OECD Economic Outlook, November 2023, https://doi.org/10.1787/7a5f73ce-en.

Pina, Á. (2016), “Making Public Finances More Growth and Equity-friendly in the Euro Area”, OECD Economics Department Working Papers, No. 1316, OECD Publishing, Paris, https://doi.org/10.1787/5jlv2jgl4kbr-en.

Rawdanowicz, Ł., Turban, S., Haas, J., D. Crowe and V. Millot (2021), “Constraints and Demands on Public Finances: Considerations of Resilient Fiscal Policy”, OECD Economics Department Working Papers, No. 1694, OECD Publishing, Paris, https://doi.org/10.1787/602500be-en.