The middle-income plateau: trap or springboard?

Rauf Gönenç and Vincent Koen, OECD Economics Department

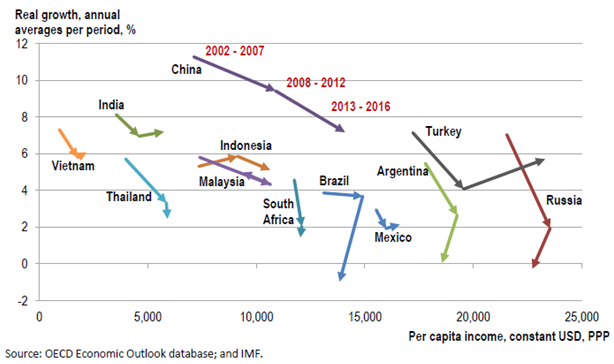

The overall slowdown and mixed growth performance of emerging market economies in the past 15 years (see chart) has revived angst about a so-called “middle-income trap”. While countries with lower incomes often do grow faster so as to close some of the gap with high income countries, they have done so at very different and uneven speeds. Clearly, a durable and consistent strengthening of growth in these economies is key for global growth to return to higher long-term averages, as underlined in the latest OECD Interim Economic Outlook.

But how compelling is the notion of such a “middle-income” trap? A guided tour of the recent literature (Gönenç, forthcoming) shows that provided countries adopt the right policies, they are not doomed to get stranded mid-way but can and do converge with the most advanced economies.

Indeed, a forensic investigation of the statistical evidence reveals that middle-income countries, defined according to GDP per capita or distance to the US benchmark, manage “escape velocity” to higher income levels more often than either poorer or richer countries do (Han and Wei, 2017). However, growth slowdowns are admittedly also more frequent in the middle-income group, which therefore displays greater dispersion in performance.

One reason is that the impact of economic policies on GDP growth is greater at middle than at lower and higher income levels, as shown in recent econometric analysis undertaken at the OECD (Égert, forthcoming).

Earlier long-term growth regressions have highlighted four areas that influence the speed of convergence, and where most middle-income countries have ample room for progress:

- Macroeconomic stability and openness, which are enhanced by trade and investment liberalisation, flexible exchange rates, sustainable public finances and strict financial sector supervision.

- Education, through the twin channels of workforce employability and productivity (Koen et al., 2013).

- Law and rule enforcement, which is hard to quantify but better captured in recent work (Guillemette et al., 2017).

- Financial development and diversification – from bank lending to various forms of equity funding, so that savings go to productive uses and entrepreneurs can more readily access funding (Cournède and Denk, 2015).

Even so, regressions leave much of the cross-country variation in growth unexplained. Growth remains a highly idiosyncratic process and may pick up when conditions – as captured by the indicators used in such regressions – look unfavourable, and vice versa (Levy and Rodrik, 2017). One reason may be related to how entrepreneurship flourishes, or is hindered, an area where experience varies considerably across countries and time for myriad reasons.

Many of the relevant factors were recognised already in the early 1960s by Rostow (1960) and others when they advised international organisations and the Kennedy administration on how to promote economic take-off in the developing world, calling for a shift in focus from individual infrastructure projects to more systemic changes in economic incentives and institutions. The latest econometric evidence supports their underlying insight that pushing ahead with reforms on a broad front should enable these economies to catch up over time with the more advanced ones.

Further reading

Cournède, B. and O. Denk (2015), “Finance and growth in OECD and G-20 countries”, OECD Economics Department Working Papers, No. 1223.

Égert, B. (forthcoming), “Quantification of structural reforms: Extending the framework to emerging market economies”, OECD Economics Department Working Papers.

Gönenç, R. (forthcoming), “The middle-income plateau: trap or springboard?”, OECD Economics Department Working Papers.

Guillemette, Y. et al. (2017), “A revised approach to productivity convergence in long-term scenarios”, OECD Economics Department Working Paper, No. 1385.

Han, X. and S. Wei (2017), “Re-examining the Middle Income trap hypothesis (MITH): What to reject and what to revive?”, Journal of International Money and Finance, Vol 73.

Koen, V., R. Herd and S. Hill (2013), “China’s March to Prosperity: Reforms to Avoid the Middle-income Trap”, OECD Economics Department Working Papers, No. 1093.

Levy, S. and D. Rodrik (2017), “The Mexican paradox”, Project Syndicate, 10 August.

Rostow, W. (1960), The Stages of Economic Growth, Cambridge University Press.