Paving the way towards prosperity in Malaysia

by Jens Arnold and Ken Nibayashi

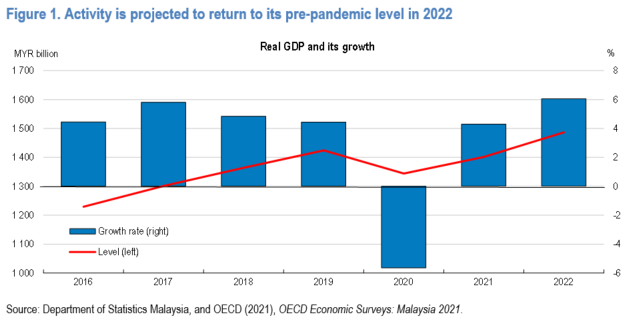

Malaysia’s economy has achieved an impressive growth since the 1960s, with average yearly growth of over 6%. It has been ahead of regional peers in terms of per capita incomes and has been able to consolidate this lead. While incomes were only one-third of the World Bank’s threshold for high-income countries in 1989, it has approached and is set to surpass that threshold by 2028 (Figure 1).

Figure 1. Rapid economic development has boosted Malaysia close to high-income status

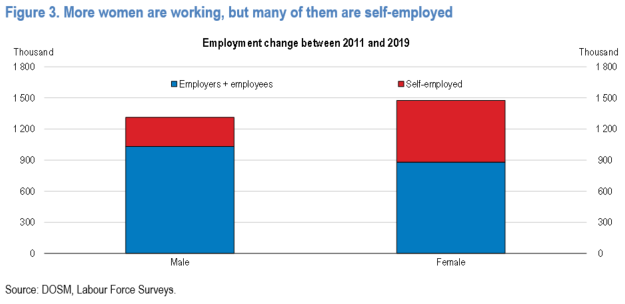

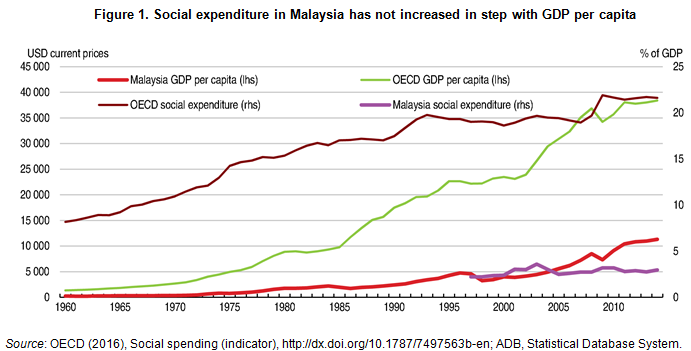

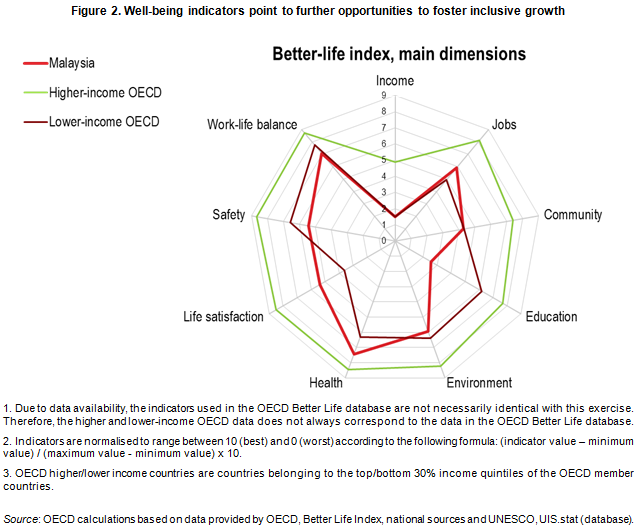

Strong growth has also propelled impressive social progress. Poverty has declined consistently over the last decades, and poverty rates have narrowed across different ethnic groups. Income inequality has also fallen, and labour force participation has trended upwards. At the same time, more could be done to create better and more equal opportunities in Malaysia, as highlighted in the recent OECD Economic Survey of Malaysia (OECD, 2024). Income inequality remains higher than in regional peers, and labour force participation among women remains some 26 percentage points lower than among men, partly related to difficulties of accessing affordable childcare. As incomes rise, Malaysians are likely to demand better public services and better opportunities, and this may require different policies from those that were successful in the past.

Pension coverage, for example, is narrow and inadequate. More than 60% of the population are not covered by any old-age pension scheme, and those who are often fail to receive a decent pension. As the population ages, more and more elderly Malaysians will reach retirement age without any type of old-age pension to rely on. Non-contributory social assistance pensions could help fill current coverage gaps in the future, but their current coverage and benefit levels are very low.

In the same vein, social assistance programmes could do more to support those in need. Different programmes are fragmented and poorly targeted, managed by multiple agencies at different levels of government. Benefit levels are generally too low to make a real difference for vulnerable households. Even for the lowest income decile, cash transfers augment market incomes by only around 13%, and overall spending on social assistance amounted to only 1% of GDP in 2023.

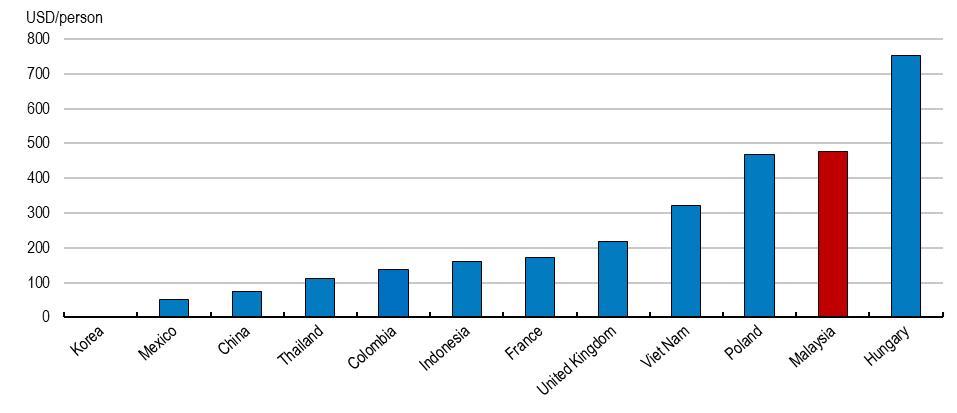

By contrast, Malaysia spent 3.5% of GDP on fossil fuel subsidies in 2023, which are counted as social assistance in its public accounts. But these subsidies are particularly ineffective as a social policy tool. Estimates suggest that the most affluent 10% of income earners receive almost three times more in fuel subsidies than the decile with the lowest incomes. Fossil fuel subsidies also provide the wrong price signal for reducing greenhouse gas emissions, and Malaysia’s fuel subsidies are particularly high in international comparison (Figure 2). Shifting spending from subsidies to pensions and well-targeted, unified social assistance benefits could support substantial improvements in social inclusion.

Figure 2. Fossil fuel subsidies per capita in selected countries, 2022

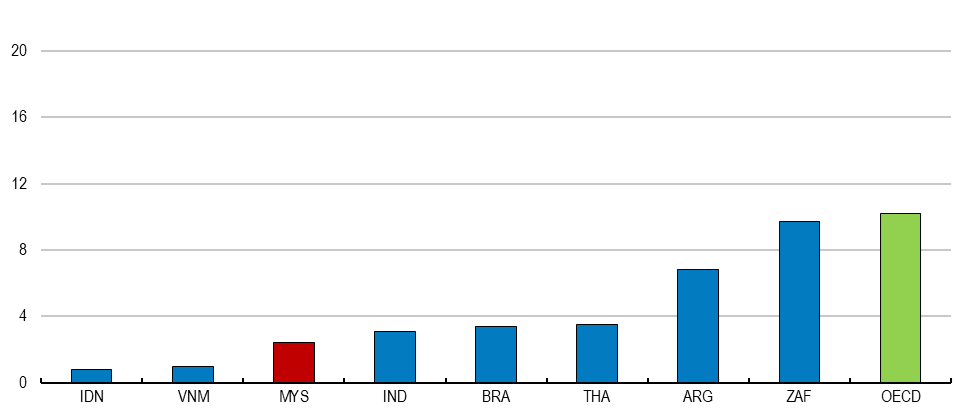

These kind of reforms could boost the effectiveness of taxes and transfers for reducing inequalities. Currently, public policies reduce income inequality by 2.4 points of the Gini coefficient, a widely used inequality measure (Figure 3). This reduction in inequality is more than what Indonesia and Viet Nam achieve, but it falls short of the 3.5 points in inequality reduction that taxes and transfers generate in Thailand, and is much less than in the average OECD country where taxes and transfers reduce inequalities by more than 10 points of the Gini coefficient.

Figure 3. Inequality reductions are small

Impact of public policies on income inequality

Better labour market policies could also help Malaysia to make further progress towards higher material living standards. More than one in four workers in Malaysia work in informal jobs, particularly older and less educated ones. Incentives for formal job creation could be improved through less rigid labour market regulations and by exempting low-wage workers from mandatory contributions to the pension fund, especially as non-contributory basic pensions are expanded. Even for those with higher skills, labour market reforms could improve job quality and strengthen productivity. Many people, particularly recent tertiary graduates, work in occupations that do not match their skills. Better alignment of tertiary education with labour market needs, a reorganisation of vocational education and training and more investment into adult education could help to reduce skills mismatches.

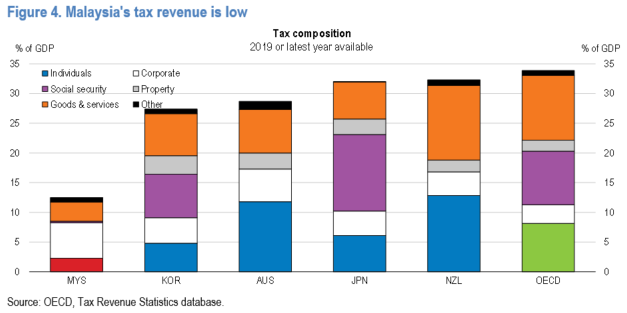

Delivering better public services and creating better opportunities will also call for substantial reforms on the fiscal side. Spending existing public resources in a more effective way should be a first step, for example by phasing out fossil fuel subsidies, but also through a better coordination of fragmented policy programmes in areas such as social protection or support to small and medium enterprises. Beyond these improvements in spending efficiency, there may also be a case for raising additional public revenues. Current tax revenues remain below 12% of GDP, which is low even in a regional comparison, and places tight limits on what Malaysia’s public sector can deliver. Establishing a well-designed value added tax, broadening the tax base of personal income taxes and improvements in tax administration would be ways to expand the resources available. Providing solid financing for future spending needs that will arise as Malaysia becomes a high-income country is likely to be one of the major challenges in coming years.

Malaysia’s ascent towards a high-income economy is remarkable, with robust and resilient growth and visible improvements across many dimensions. The analysis and policy recommendations presented in the newly launched OECD Economic Survey of Malaysia (OECD, 2024) are aimed to help the country build on its past achievements and maintain a strong performance in the years to come.

References

Commitment to Equity Institute (2023). Standard Indicators, Tulane University.

IEA (2023). Fossil Fuel Subsidies Database, International Energy Agency

OECD (2024). OECD Economic Survey of Malaysia, OECD Publishing, Paris.

OECD (2024). OECD Income Distribution Database, OECD Publishing, Paris.

World Bank (2023), Raising the Tide, Lifting All Boats. Malaysia Economic Monitor (October), Washington, DC.