Strengthening the recovery and accelerating the green transition in Hungary

By Pierre-Alain Pionnier and Donal Smith

After a strong demand-based recovery from the economic fallout of the COVID-19 pandemic, Hungary’s economy contracted in 2023 while inflation climbed higher than elsewhere in the European Union, at some point surpassing 25%. The good news is that growth has restarted in mid-2023 and inflation is receding. At the same time, both fiscal and monetary policies will need to work hand-in-hand to fight remaining inflationary pressures and recreate fiscal space for future spending needs, as highlighted by the recently published OECD Economic Survey of Hungary (OECD, 2024).

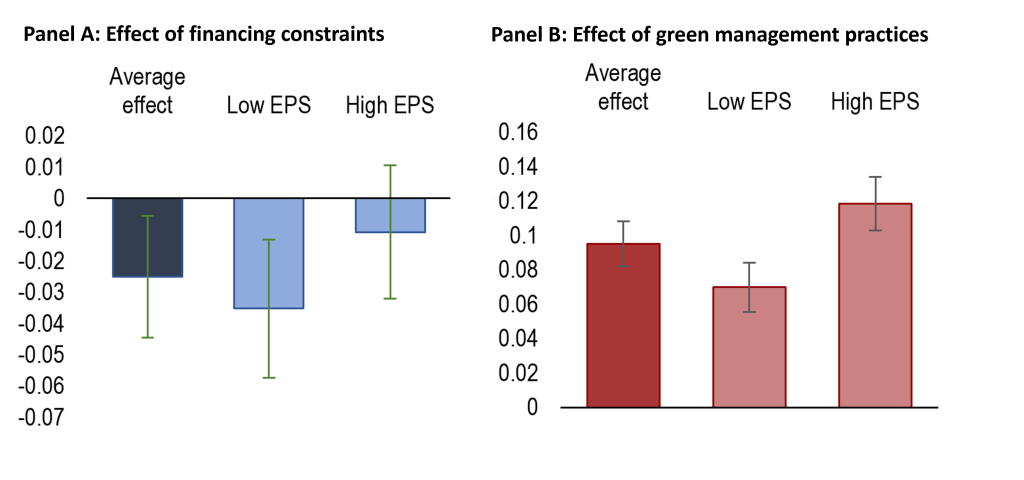

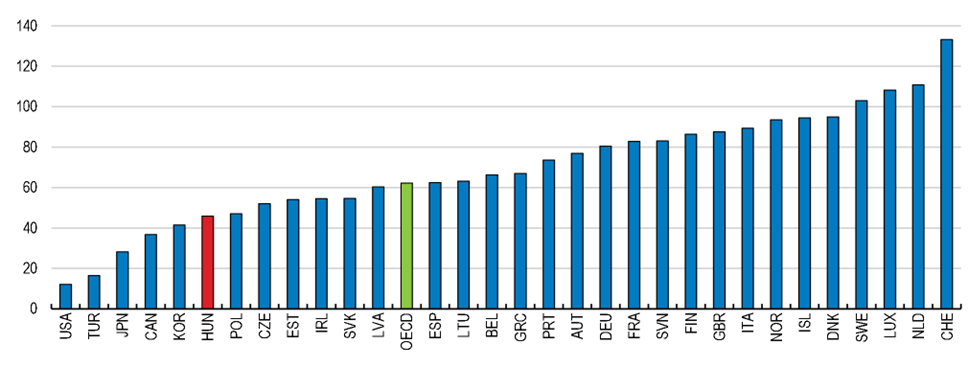

One of the big challenges of the next decades will be to move towards a greener and more sustainable economy. Hungary has made progress in this direction, but this progress needs to accelerate. For a large part, emission reductions achieved so far have been related to the changing industry structures as the economy transitioned to a market economy in the early 1990s. Regulations and standards are currently the main tools used to support the green transition, but they will likely be insufficient to reach the 2030 and 2050 emission targets. Price signals are key for an efficient decarbonisation. The European Union’s Emission Trading Scheme is the main price-based measure to curb emissions in Hungary, but it only covers a third of emissions. As a result, average carbon prices are low in international comparison, exacerbated by energy subsidies on fossil fuels (Figure 1).

Figure 1. Carbon prices are low

Net effective carbon rates, all sectors, EUR per tonne of CO2, 2021

Note: Net effective carbon rates consist of emission trading prices, carbon taxes, and fuel excise taxes, minus fossil fuel subsidies. The OECD average is an unweighted average of net effective carbon rates across OECD countries.

Source: (OECD, 2022)

In the residential sector, price caps keep retail electricity and gas prices low for many households. Along with poor dwelling insulation, this may explain why household energy consumption is among the highest in Europe (Figure 2). If energy support to households were restructured and price caps replaced with targeted cash transfers, this would not only protect vulnerable households, but it would also improve energy efficiency incentives and cost less, as energy subsidies reached 2.5% of GDP in 2023. Part of the fiscal savings could be allocated to upgrade the housing stock of financially constrained households.

Figure 2. Households’ energy consumption is high

Energy consumption of households for heating, in kilograms of oil equivalent (koe) per m²

Note: For each country, energy consumption is corrected for changes in meteorological conditions across years.

Source: Odysee-Mure, https://www.odyssee-mure.eu/

Emissions from the transport sector have increased since 1990 and now represent 20% of overall greenhouse gas emissions. Car ownership has expanded along with rising income levels, but Hungarians drive one of the oldest car fleets in Europe, and over longer distances than elsewhere in Europe. Transport emissions could be limited through better incentives to replace high-polluting cars and choose public transportation where available, but also by improving the quality of public transportation and limiting urban sprawl, especially around Budapest.

On the supply side, meeting emission targets will require a significant increase in electricity production from low-carbon sources. Current plans are mostly focused on solar energy and biomass, particularly wood. While burning wood is a low-emission energy source seen over the long run, when accounting for the replanting of trees, in the short run it would increase emissions and reinforce an already acute air pollution problem. Hungary could make better use of its potential for wind and geothermal energy, but that will require removing restrictive rules on windmill installation and easing licensing procedures for geothermal energy projects. Moreover, the development of intermittent energy sources like solar and wind energy will require massive investments in the electricity grid.

Ensuring a sufficient low-carbon electricity supply will be a challenge. Hungary currently imports 40% of its electricity from neighbouring countries, which are engaged in a similar decarbonisation process. Eventually, Hungary will also have to replace an ageing nuclear plant, and large projects like this can be subject to financial, technical, and even geopolitical risks.

All of these considerations will make it even more important to speed up progress on rolling out low-carbon renewable energy sources. Only this can make Hungary’s progress towards living standards more sustainable and leave a brighter future for the next generation.

References:

OECD (2022), Pricing Greenhouse Gas Emissions: Turning Climate Targets into Climate Action, OECD Series on Carbon Pricing and Energy Taxation, OECD Publishing, Paris, https://doi.org/10.1787/e9778969-en

OECD (2024), OECD Economic Survey of Hungary, March 2024, OECD Publishing, Paris, available at https://doi.org/10.1787/795451e5-en.