Lithuania: Ensuring the rising tide lifts all boats

by Vassiliki Koutsogeorgopoulou, Lithuania Desk, OECD Economics Department

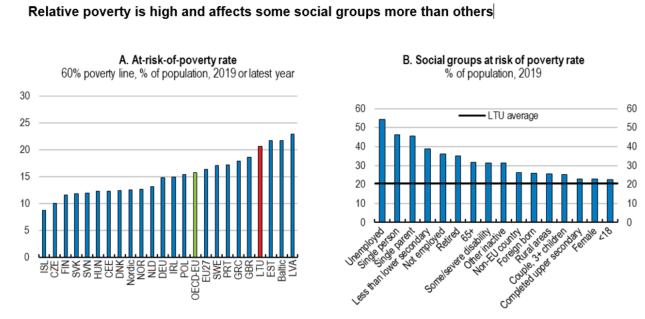

As a result of Lithuania’s strong economic growth performance since the mid-1990s, incomes are catching up fast towards the average of OECD countries. But relative poverty is high, especially among the unemployed, less educated, single parents, people with disabilities and the elderly. High poverty not only fuels social exclusion but it also dents the productive potential of those affected. The Covid-19 crisis adds to these challenges, not least through a sharp increase in unemployment since the onset of the pandemic. Tackling poverty calls for a comprehensive strategy that provides sufficient social support and better labour market opportunities for the vulnerable.

The at-risk-of-poverty rate is the share of persons with an equivalised disposable income below the at-risk-of-poverty threshold, set at 60% of the national median equivalised disposable income (after social transfers) (Eurostat definition). Averages are calculated for the most recent value of all countries with available data (unweighted). Average groups are as follows: EU27: European Union members; OECD-EU: EU countries who are OECD members; Baltic: Estonia, Latvia, and Lithuania; Nordic: Denmark, Finland, Iceland, Norway, and Sweden; CEE (Central European Economies): Czech Republic, Hungary, Poland, Slovak Republic, and Slovenia.

Source: OECD Income Distribution database; Statistics Lithuania; and EU-SILC.

The tax-transfer system could do more to reduce poverty. Social benefits remain low, despite recent increases, and the provision of support is not yet individual-based. Increasing social support that is well-tailored to the needs of the most vulnerable, while keeping work incentives, is essential. The pension system also needs to safeguard more against old-age poverty by ensuring adequate pension levels. More than a third of seniors have incomes below 60% of the national median. The additional spending can be financed through efforts to utilise under-exploited tax bases, including by tackling tax evasion.

Social services also need to improve. Not all children have access to early childhood education and care, despite its critical role in reducing the impact of social disadvantage. A case can therefore be made to maintain efforts to expand early education services, with a special focus on children from disadvantaged backgrounds and those living in rural areas. Another challenge is to meet the housing needs of the poorer segments of the population. Around 10 000 low-income households are still awaiting social housing, calling for increased investment in this area. Lithuania also needs an integrated approach to homelessness, guided by international best practices.

Fighting poverty in a decisive manner ultimately requires more and better quality jobs. There is scope, in this context, to improve the job opportunities for less-skilled workers through a further reduction in the labour tax wedge, which remains above the OECD average. Equally important are measures to boost the productivity of less-skilled workers, including through well-designed incentives to enhance participation in adult learning programmes, helping re-skilling and upskilling. At the same time, informality needs to be reduce to ensure high-quality jobs. The New Labour Code makes strides in this regard.

Increased spending on activation programmes, upon a close monitoring of outcomes, is essential to better integrate displaced workers in the labour market and to reduce poverty. Ensuring successful labour market and social integration of the vulnerable groups requires close collaboration of all stakeholders, with some encouraging initiatives already underway.

As the economy recovers from the Covid-19 crisis, the Lithuanian authorities will have the opportunity to make headways in all these areas through continued reforms so that all boats can be lifted as the tide rises anew.

References:

OECD (2020), OECD Economic Surveys: Lithuania 2020, OECD Publishing, Paris.

https://doi.org/10.1787/62663b1d-en.