Structural reforms are key for a more prosperous and inclusive India

by Laurence Boone, OECD Chief Economist, Isabelle Joumard and Christine de la Maisonneuve, India Desk, OECD Economics Department

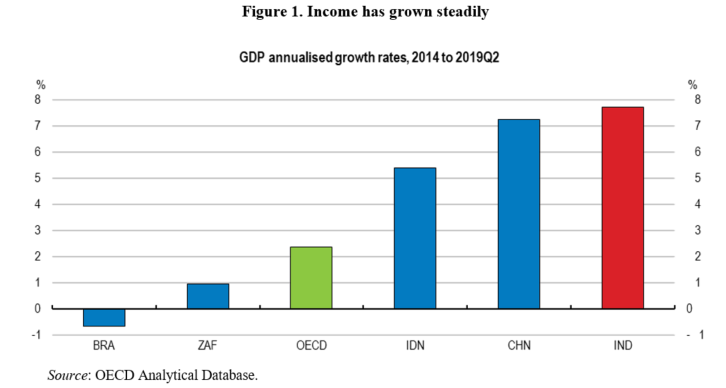

Income has increased fast in recent years and millions of Indians have been lifted out of poverty. India has also become a key player in the global economy. The implementation of an ambitious set of reforms has supported economic activity and helped put a break on inflation and on both fiscal and current account deficits. Reforms such as:

• The Goods and Services tax replacing a myriad of indirect taxes.

• A leaner corporate income tax structure bringing India more on par with peers.

• The Insolvency and Bankruptcy Code speeding up the reallocation of resources from declining firms and industries to those with more promising prospects.

• Electricity reached all villages in 2018 and;

• Almost 100 million toilets have been built since 2014.

Nevertheless, economic activity is slowing down and challenges remain, notably:

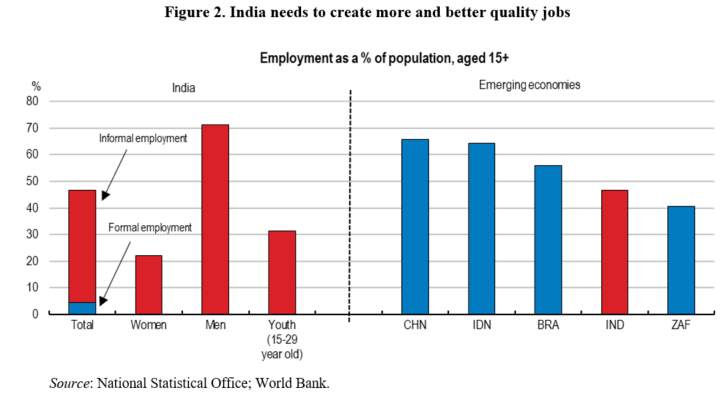

• The creation of quality jobs has not matched the number of new comers on the labour market, resulting in under-employment and rising unemployment. Women and the youth are most affected.

• Nearly 90% of jobs are informal without job protection

• Inequality in wealth and in access to public services remains wide.

• A large share of the population suffers from severe air pollution.

• Corporate investment as a share of GDP no longer declines but has failed to rebound.

• Construction has weakened despite large housing and infrastructure needs.

Boosting incomes with macroeconomic policies has limits. Policy interest rates can be cut further but their impact on lending rates is limited by high administered deposit rates. Large non-performing assets in financial companies’ balance sheets also weigh on the supply of loans. The already high public sector borrowing requirements and debt to GDP ratio limit the government’s ability to support demand.

Boosting growth and making it more inclusive require accelerating the pace of structural reforms. Slower growth in partner countries and geopolitical uncertainties have recently taken a toll on economic activity. However, remaining constraints to create jobs and grow businesses – including the ongoing stress in the financial sector – also play a role. Already passed reforms should be fully implemented, e.g. by adding new judicial personal and benches to hasten bankruptcy proceedings. Labour, land and financial regulations should be modernised to attract investors and create more quality jobs and income. It is a critical moment, with opportunities to seize as companies around the globe are considering relocating their production sites in the wake of changing input costs and trade tensions.

The full benefits of structural reforms take time to unleash while costs are often born upfront. Setting a timetable by which government actions could be assessed may help avoid a political backlash. People losing from the reforms may need support to adjust (e.g. skilling programmes) or income support.

Delivering better public services and social protection for all Indians is also key to promote wellbeing.

India should train more doctors and nurses to meet the population’s needs. It should also build a sound and fair retirement system. Putting more public resources on health and social transfers will require rebuilding fiscal space. Two avenues should be considered. On the spending side, further reforms should help raising the effectiveness of existing schemes, by better directing support to those in need, and containing public enterprises’ financing needs. On the revenue side, there is scope to mobilise additional revenue from property and the personal income tax (OECD, 2017).

References:

OECD (2019), OECD Economic Survey India, OECD Publishing, Paris.

OECD (2017), OECD Economic Survey India, OECD Publishing, Paris. https://doi.org/10.1787/eco_surveys-ind-2017-en.