Does Denmark need yet another tax reform?

By Mikkel Hermansen and Valentine Millot, OECD Economics Department

The answer is yes according to the recent OECD Economic Survey of Denmark. The ratio of tax revenue to GDP in Denmark is 46%, very close to the highest country (France: 46.2%) and well above the OECD average (34.2%). Past reforms have made considerable progress in shifting taxation away from labour income to other sources such as environmental taxes. Nevertheless, Denmark should continue to reform taxes so as to promote investment in innovation, higher education and entrepreneurship, which would help to revive Denmark’s slow productivity growth.

High marginal tax rates on labour and capital income are particularly harmful for productivity and should be kept at reasonable levels. At 55% these rates are among the highest in OECD countries (Figure 1). For corporate income taxation, it is recommended to introduce an allowance for corporate equity (ACE), as done in Belgium, Italy and Portugal. This would reduce the incentive to finance investment by debt, rather than equity, and would help to boost labour productivity and wages. It is also recommended to cancel the lower inheritance taxation for family-owned businesses. Evidence suggests that this is detrimental to productivity since the family successor tend to underperform compared to non-family managers.

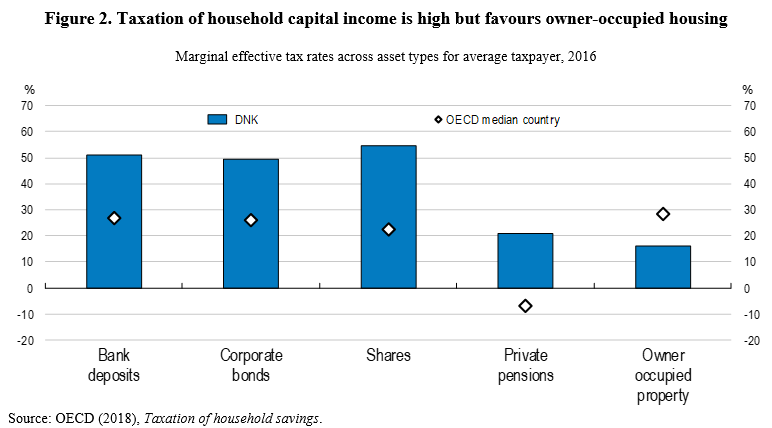

Another key reform would be to reduce the personal income tax deduction of interest expenses. Denmark has one of the most generous tax incentives for interest expenses in the OECD (OECD, 2018). It is not surprising therefore, that Danish households hold the highest gross debt to income ratio in OECD countries, which poses risks to financial stability in case of sharp rise of interest rates. By contrast, personal investment in more productive assets, such as company shares, is discouraged by the tax system (Figure 2). With interest rates at historically low levels, now would be a good time to reform.

References

OECD (2019), OECD Economic Surveys: Denmark 2019, OECD Publishing, Paris, http://dx.doi.org/10.1787/eco_surveys-dnk-2019-en.

OECD (2018), Taxation of Household Savings, OECD Publishing, Paris, https://doi.org/10.1787/9789264289536-en