Income redistribution across OECD countries: main findings and policy implications

By Orsetta Causa, OECD Economics Directorate, and Anna Vindics and James Browne, OECD Directorate for Employment, Labour and Social Affairs

Income inequality has increased in most OECD countries over the past two decades. This is both because market incomes (wages, dividends, interest income) have become more unequally distributed, and also because redistribution through taxes and transfers has fallen. New OECD work explores cross-country evidence on trends in income redistribution since the mid-1990s to shed some light on the main drivers of the general decline.

New evidence on redistribution and its policy drivers

One finding is that the decline in redistribution was primarily explained

by a fall in cash transfers, which in

the majority of OECD countries account for the bulk of redistribution (Causa

and Hermansen, 2017). In turn, the decline in cash transfers was largely driven

by a fall in insurance transfers

(e.g. unemployment insurance, work-related sickness and disability benefits). In

some countries, this was partly mitigated by an increase in assistance transfers (e.g. minimum

income transfers, means- or income-tested social safety net). Personal income taxes also contributed,

but played a less important and more heterogeneous role.

To shed light on the underlying drivers, further investigation has

been conducted on the basis of both micro-model simulation analysis (Browne and

Immervoll, 2019) and regression analysis (Causa et al 2018). The main finding is

that policy changes during the past two

decades have contributed markedly to the decline in redistribution. This was

primarily driven by cuts to cash income

support to unemployed households, but also by cuts to the taxation of top incomes and income from capital, as globalisation

puts pressure on governments to shift away from highly mobile tax bases. At the same time, not all policy changes

went in the direction of reducing redistribution: at lower earnings levels,

income taxes have frequently been reduced for low-income working families.

This is not to say that changes

in redistribution were entirely the result of changes in policy design. In several countries, structural factors such

as population ageing and changes in the composition of households and

unemployment rates have also had an impact. For instance, the extent of

redistribution through unemployment insurance transfers fell in countries

experiencing a decline in unemployment over the period under consideration.

However, the precise contribution of each of these structural factors to the

general decline in redistribution is difficult to assess as their impact cannot

easily be disentangled from that of policy changes.

The motivation for the decline in redistribution after the mid-1990s

One objective behind the policy-induced reduction in

redistribution has been to raise employment and economic efficiency in

particular by strengthening work incentives (make-work-pay policies). In

principle, the pursuit of policies to bring more individuals into the job

market, especially among low-income households, might have succeeded in boosting

growth while at the same time reducing income inequality. In practice, the

continued rise in inequality observed in many countries since the mid-1990s suggests

that the positive employment effects of the tax and transfer policy reforms on

the income of poorer households have not been sufficient to compensate for the

reduction in redistribution.

Does this mean that in setting their redistribution policies government inevitably have to choose between more efficiency and less inequality? Not necessarily.

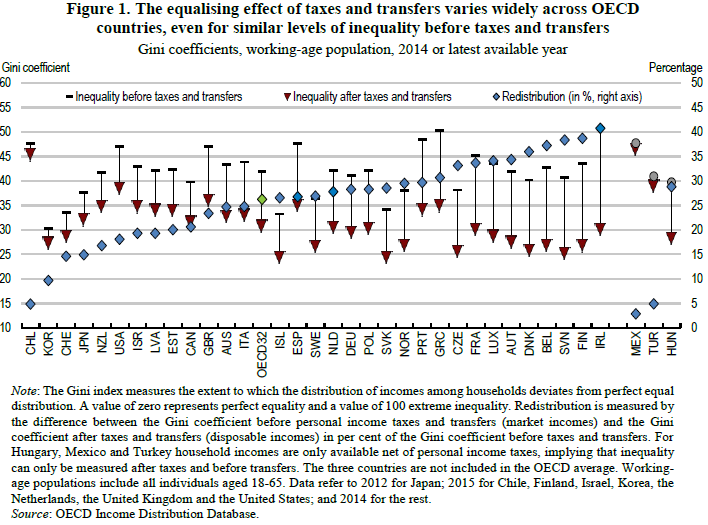

First, there is substantial variation in the extent of inequality reduction through taxes and transfers across the OECD area (Figure 1), including between countries that have similar GDP per capita and overall growth performance. Second, cross-country differences in income redistribution do not only reflect the levels of taxes and spending on cash transfers to the working-age population. They also reflect the extent to which personal income taxes are levied progressively with income levels and the extent to which cash transfers target less affluent households (Figure 2).

All this suggests that many OECD countries have scope for making their tax and transfer systems more redistributive without undermining efficiency. However, simply reversing the changes that have led to reduced redistribution is unlikely to be the most effective approach to reducing inequality.

Leveraging synergies between equity and efficiency objectives

Countries can learn from successful reform strategies that have

leveraged synergies between equity and efficiency objectives. Such is the case of stepping-up carefully

designed in-work benefits and credits: these programmes should be as simple

as possible to make them accessible to potential recipients, and associated income

support should not be withdrawn too quickly as earnings rise to ensure that

work incentives are maintained.

More generally, tax and transfer reforms should be forward-looking, taking into account the rapidly changing context in which policy operates, not least technological developments, changes in the nature of work as well as ageing populations and the associated pressures on government budgets. For example:

- Social protection systems should adapt to the emergence of non-standard forms of work. Technological change, among other factors, has led to an increase in non-standard form of work and reduced the coverage of traditional social protection systems that are often based on the model of full-time permanent work for a single employer. Alternative approaches might include designing new, tailor-made benefit schemes for non-standard workers, tying social protection entitlements to individuals rather than employment relationships or making social protection more universal.

- Tax policy also needs to reflect rising top incomes and private wealth among ageing populations along with ongoing progress in international cooperation on taxation. Although top earners are very responsive to changes in income tax rates, broadening tax bases and improving compliance might be a way to increase the tax collected from this group by limiting the scope for avoidance. The equity and efficiency case for increasing the overall progressivity of tax systems is supported by recent initiatives to enhance international cooperation in tax administration (e.g. automatic information exchange).

Finally, taxes and cash transfers are not the only policies that reduce inequality in OECD countries. A comprehensive strategy for tackling inequality requires policies that promote greater equality in market incomes (i.e. incomes before taxes and transfers), such as providing access to high-quality educational opportunities from early childhood to adult training, healthcare and jobs, especially to those facing disadvantages.

References:

Causa, O. , J. Browne and A. Vindics (2019)

“Income redistribution across OECD countries: main findings and policy

implications, OECD Economic Policy Papers, No. 23, OECD Publishing, Paris

Causa, O. and M. Hermansen (2017), “Income redistribution through taxes and transfers across OECD countries”, OECD Economics Department Working Papers, No. 1453, OECD Publishing, Paris,

https://doi.org/10.1787/18151973

Browne,

J. and H. Immervoll (2018),“Have tax and transfer policies become less inclusive?

Results from a microsimulation analysis”, OECD Social, Employment and Migration

Working Papers, forthcoming.

Causa, O. A. Vindics and Oguzhan Akgun (2018) “An empirical investigation on the drivers of income redistribution across OECD countries, OECD Economics Department Working Papers, No. 1488, OECD Publishing, Paris https://doi.org/10.1787/18151973