To shorten or to lengthen debt maturity to lower debt servicing costs?

By Alessandro Maravalle and Lukasz Rawdanowicz, OECD Economics Department

Low interest rates prevailing in many advanced economies in recent years have already helped to lower the debt servicing burden, but government debt and interest payments remain large in many OECD countries. Could a further reduction in interest payments be attained by “locking-in” current low interest rates?

The answer is not straightforward as it depends on the future evolution of yield curves and budget balances, which are difficult to predict, and initial conditions related to the level and maturity structure of public debt.

To shed some light on potential debt servicing effects of changing debt maturity, we undertook country‑specific stylised simulations over the next 30 years with different assumptions about the maturity of new debt (Maravalle and Rawdanowicz, 2018). We analyse in principle two alternative debt strategies: temporary lengthening of the debt maturity of newly issued debt, i.e. up to a few years only, and permanent shortening, i.e. for 30 years. In both cases, the average debt maturity of newly issued debt changes by one year compared with the initial country-specific average remaining debt maturity.

The simulations are calibrated to reflect several key characteristics of G7 economies, in particular the current debt maturity structure and fiscal positions. We assume that interest rates will increase and the yield curve will steepen gradually during the first five years and then stabilise afterwards. Such a stylised assumption reflects the expected normalisation of monetary policy.

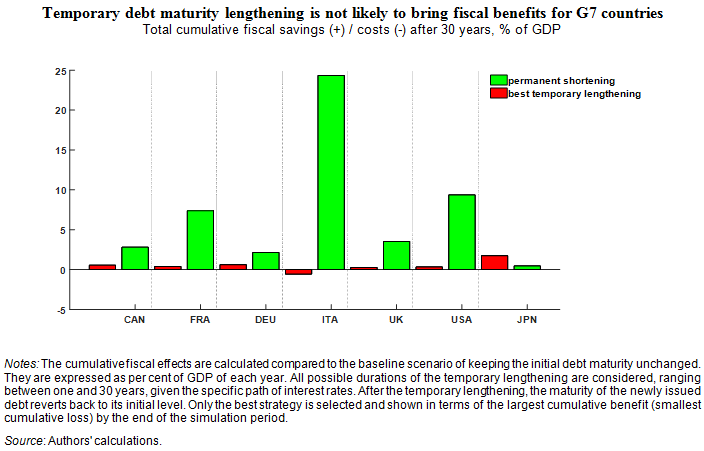

It turns out that, with the assumed increase in interest rates, a temporary lengthening of the debt maturity would not bring any reduction in debt servicing costs (figure below). The assumed initial increases in interest rates and in the slope of the yield curve are not gradual enough to reap the benefit of locking-in low interest rates. As debt matures gradually over time, the yield curve must remain low and flat for a prolonged period to reduce the overall debt servicing costs in the long term when interest rates will be higher. However, even with a more gradual and protracted interest rate normalisation, such potential fiscal benefits would be still negligible. Nevertheless, lengthening of debt maturity could be motivated by reducing rollover risks or accommodating demand from investors.

In contrast, shortening debt maturity could have non-negligible fiscal benefits for most G7 countries (figure below), but this would come at the cost of higher rollover risks. Gains could be particularly large for countries with high debt and relatively steep yield curves.

Whatever the change in debt maturity and the scenario for the evolution of the yield curve, fiscal gains would materialise only after the first decade, not helping much to lower current budget deficits.

Reference

Maravalle, A. and L. Rawdanowicz (2018), “To shorten or to lengthen? Public debt management in the low‑interest rate environment”, OECD Economics Department Working Papers, No. 1483, OECD Publishing, Paris,