The rise of self-employment in the Netherlands: is the “polder model” at risk?

By Mark Baker, Netherlands Desk, OECD Economics Department

By Mark Baker, Netherlands Desk, OECD Economics Department

The Netherlands has experienced a large rise in the number of individuals working as self-employed with the share in total employment rising rapidly over the past decade. This is the largest rise in the OECD countries. This contrasts with trends in most other OECD countries where the share has, on average, fallen over that period. There are a number of positive aspects that can be associated with self-employment, as well as possible negative aspects, implying that any policy responses to address the increasing prevalence should aim to facilitate the former while mitigating the latter.

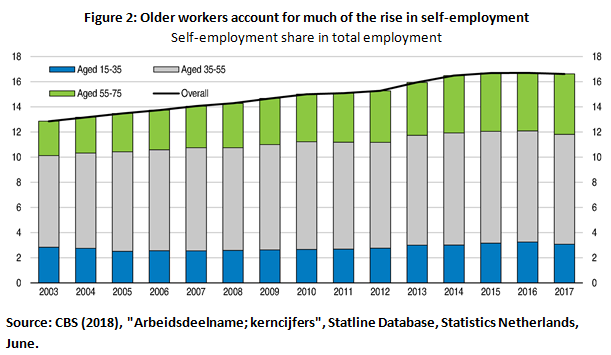

On the positive side, higher rates of self-employment could be associated with increased entrepreneurial activity, innovation and more labour market flexibility. Flexibility is particularly important in the Dutch context, where the level of protection on permanent contracts is high. Younger workers and recent migrants, who have limited attachment to the labour market, can use self-employment as an avenue to gain valuable working experience and to potentially transition towards a more permanent position. Self-employment can also be a useful avenue for older workers who want to remain marginally attached to the workforce, and potentially view their existing pension savings as adequate for their retirement. Indeed, older workers have seen the largest rise in terms of self-employment when compared to other age groups.

On the negative side, rising self-employment can also be associated with reduced job quality and job security, and can potentially be used as a method for individuals and employers to avoid tax and social security obligations, and promoting an unfair treatment across different work types. With regards to social security, the self-employed individuals have no obligation to contribute to sickness and disability insurance while employees do. Not only does this significantly reduce the tax wedge for self-employed work, but it exposes the self-employed to increased loss of income risks associated with injury or sickness. Employers are incentivised to hire self-employed contractors and potentially to re-label existing staff as self-employed contractors to lower labour costs, through lower social security contributions, and to avoid the strict protection of employment contracts. Furthermore, self-employment can be used by employers/clients to prevent paying statutory minimum wage rates.

In addition, very large tax deductions exist which further widens the difference in tax treatment between the self-employed and other workers. One of the largest deductions available is meant to incentivise increased entrepreneurial activity. However, the vast majority of the rise in self-employment has been own-account workers who tend not to scale up their business, by hiring employees, or invest in innovative activities or training, so this deduction is hardly justifiable.

The Dutch government has been active in constructing different policies to target some of these issues. Regulatory policies associated with the self-employment statement system have been reformed in recent years. To combat the potential for employers to re-brand employees as contractors, the government plans to introduce a minimum tariff system, whereby any individual earning below a stated minimum tariff, comparable to the minimum wage rate, will be deemed an employee for tax and regulatory purposes. This will be difficult to implement, however, given the potential difficulties in monitoring the hours worked of self-employed individuals.

Recommendations from the 2018 OECD Economic Survey of the Netherlands aim at ensuring a more level playing field, particularly in terms of the tax treatment, between the self-employed and other workers. The government should phase out the permanent self-employment tax deduction while also introducing coverage for sickness and disability insurance for self-employed workers. Additional to the self-employment specific recommendations, the Survey calls for a reduction in the tax burden, particularly for lower-income workers, by lowering social security expenses and also reducing the high level of employment protections through a reduction in severance pay for employees dismissed under reasonable grounds.

References:

OECD (2018), OECD Economic Surveys: The Netherlands 2018, OECD Publishing, Paris.