Enhancing Greek exports is key to jobs and growth

By Christine de La Maisonneuve, Economist on the Greek desk, Economics Department

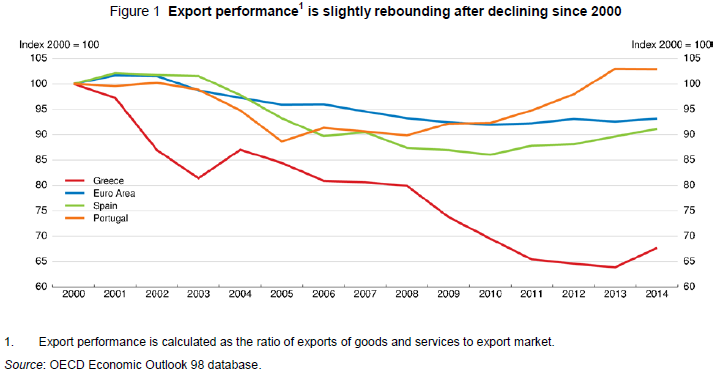

With weak domestic demand and a relatively low export share in the economy there is much potential to raise exports. Despite a recent pick-up Greek export performance deteriorated in the last decade particularly in the service sector and by much more than in the Euro area on average (Figure 1).

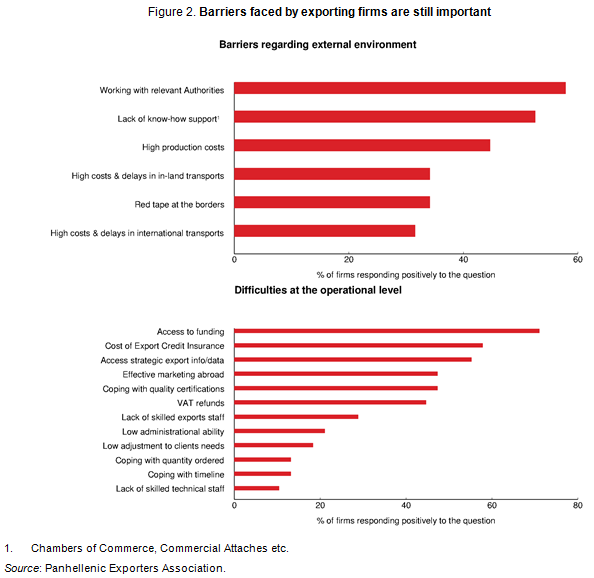

The decline in unit labour costs since 2010 has restored cost competitiveness, but the response of exports has been sluggish due to severe liquidity constraints and lagged price adjustment. While some of the decline reflects drops in oil prices and world shipping demand, structural problems in product markets, barriers to exporting, access to finance and administrative burden affect competitiveness and export performance (Figure 2).

Export performance is also affected by low integration in global value chains (GVCs). The small size of the manufacturing sector, low FDI flows, inefficient infrastructure and dominance of small and informal enterprises have contributed to a low technology content of goods exports and make integration difficult (Bank of Greece).

Competitiveness and exports can be boosted by policy reforms. Policies that create a business environment where firms can easily enter (and exit) the market and young high-performing firms can thrive and grow are particularly important. Increasing the efficiency of the judiciary system is important to improving the business environment as it reduces uncertainties and transaction costs. The implementation of a ‘national single window’ for exports, as foreseen by the National Trade Facilitation Strategy (NTFS) for Greece, would act as a one-stop shop, specifically for export procedures and is expected to significantly alleviate the high cost and long time periods involved in exports. This would help competitiveness. Liberalising further product markets and better bankruptcy procedures would also help SMEs grow.

Improving investment in human and knowledge-based capital would enhance integration in GVCs. This calls for more support to quality education and skills training. This will require improving the quality of teachers by linking teaching evaluation to effective professional development, making schools more autonomous and accountable and introducing a performance evaluation system for universities. Also innovation and investment in ICT would enable product differentiation and gains in market shares. For instance, only around 10% of Greek firms sell via e‑commerce compared to 21% in OECD countries on average.

As many services particularly related to R&D, product design and development are inputs to export products, it is important to reduce inefficiencies in input markets. Further liberalisation in regulated professions such as engineers would boost high-technology goods exports. The quality of transport infrastructure could also be improved. The gap is particularly important for railroad and, albeit to a lesser extent, road infrastructure. Reforms have been put in place to enhance the weak transportation sector, but there is still considerable scope for developing port activities as a gateway to the land transportation network, not just for Greece but for the entire region. Boosting investment in logistics should continue. One way forward would be to make better use of public land through concessions or privatisations to facilitate investment in logistics and infrastructure.

References

De la Maisonneuve, Christine (2016), How to Boost Export Performance in Greece, OECD Economics Department Working Paper no. 1299.

OECD (2016), Economic Surveys: Greece 2016, OECD Publishing, Paris.